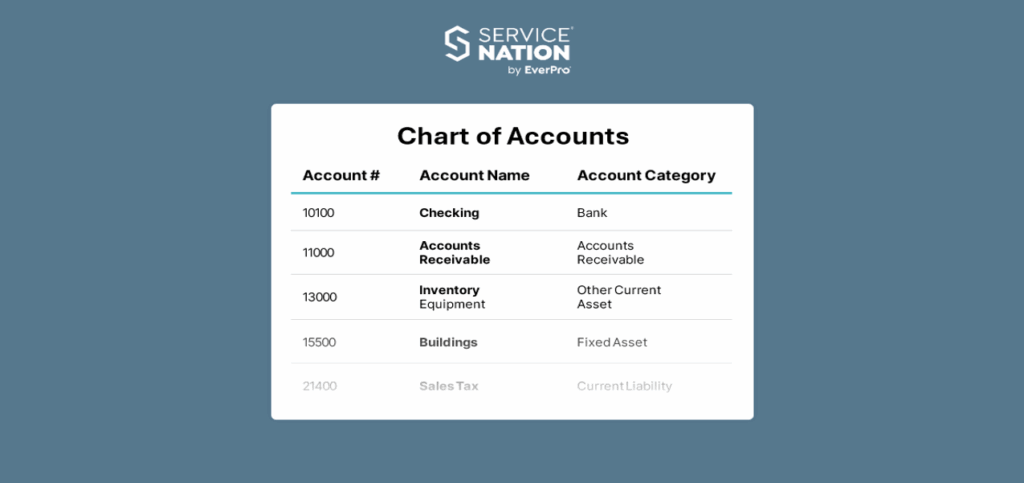

We understand that managing the financial backend of a demanding home service business can be challenging. If you find yourself struggling to trust your financial reports, or if analyzing your Profit and Loss statement feels more confusing than helpful, the root issue is often your Chart of Accounts (COA).

Think of a COA as the financial knowledge “backbone” you need to accurately measure and maintain your profit. When it isn’t specifically structured for the home service industry, it can unintentionally create costly data blind spots.

COA: The Financial Foundation of Your Profit

Here are a few ways that an potentially unoptimized Chart of Accounts can create financial blind spots within a company.

1. Missing Clarity on Departmental Performance

Your lines of business—such as Installation versus Service/Repair—have naturally different margins. Without departmentalizing your COA to track costs and revenue separately, it becomes impossible to accurately identify which part of your business is truly profitable and where strategic pricing adjustments are needed.

2. Uncertainty in Service Rate Calculation

When overhead costs are structured broadly and are difficult to attribute to individual jobs, calculating a truly profitable Service Rate becomes guesswork. Lacking a systematic overhead allocation methodology built into your COA means your pricing decisions might be skewed because your true costs of operation are unclear.

3. Oversight on the Full Financial Picture

Many successful business leaders focus intensely on the Profit and Loss statement, but the Balance Sheet holds crucial details about the true health of your company, such as whether it is overburdened with excessive debt. If your COA is disorganized, you risk overlooking these hidden signals because the accuracy of your P&L relies heavily on the Balance Sheet being correct.

4. Hidden Costs in Payroll Mapping

Accurate financial tracking is compromised if specific payroll items (such as commissions, bonuses, and corresponding taxes) are not correctly mapped within the COA. Issues like misclassified revenue or a lack of proper departmental financial structure compromise accurate year-end analysis.

5. Difficulty in Measuring Industry Standards

Without a standardized COA structure, your financial data is incompatible for effective comparison. This prevents valuable benchmarking and reduces the power of financial analysis tools that help you gauge your performance against established industry expectations.

Your Five-Step Plan for Accurate Financial Control

If these scenarios sound a little too familiar, here are a few immediate, structured action items you can take to stabilize your financial foundation and regain control of your books.

- Restructure and Clean Up: Establish a solid foundation for reliable financial reporting by conducting a comprehensive chart of accounts cleanup and restructuring methodology immediately.

- Departmentalize Your Books: Implement a departmental accounting structure (known as a class structure). For an HVAC contractor, this means separating your business into Installation and Service/Repair at a minimum.

- Systemize Overhead Allocation: Develop and standardize a monthly overhead allocation process. This step is critical because it ensures overhead costs are correctly assigned to departments, allowing you to calculate profitable pricing.

- Fix Payroll Mapping: Implement systems for labor cost tracking and verify that all payroll items are correctly mapped to the necessary accounts for accurate financial tracking and optimization.

- Upgrade to Accrual Accounting: Transitioning from cash-based accounting to accrual-based accounting provides a truer picture of your company’s scorecard and financial stability.

The Path to Financial Confidence

To create a successful business and calculate genuinely profitable pricing, you must have an accurate and reliable financial framework in place. That’s why we designed the Service Nation Chart of Accounts specifically for this industry, enabling members to implement standardized best practices and simplify their accounting.

With a Service Nation membership, you gain immediate access to our industry-specific Chart of Accounts Template, so stop guessing and start growing with the departmentalization and standardization you need for precise cost tracking and financial analysis. Use our template to set truly profitable pricing and accurately benchmark your company against industry performance goals.